The era of quantum computing is approaching faster than expected, posing a significant threat to the cryptographic systems that protect financial transactions, customer data, and core banking operations. Cybercriminals are already intercepting encrypted information in anticipation of breaking it later with quantum capabilities – a strategy known as “harvest now, decrypt later” (HNDL).

Leading organizations, including NIST, the G7, the BIS, and the World Economic Forum, warn that HNDL attacks are a critical threat to data security, particularly for the financial sector. Sensitive information intercepted today may be decrypted in the future, exposing years of financial records and personal data to exploitation.

Banks must act now to protect their infrastructure with quantum-safe solutions.

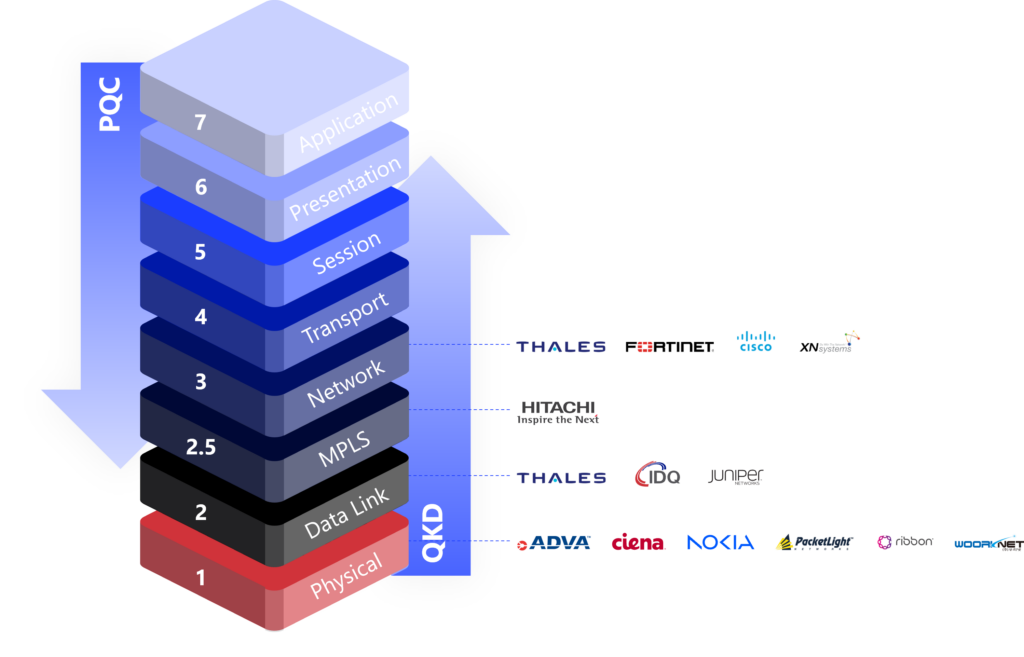

Migrating to a quantum-safe infrastructure isn’t just a future-proofing measure – it’s essential for maintaining security today. ID Quantique provides an end-to-end approach that combines Post-Quantum Cryptography (PQC) with Quantum Key Distribution (QKD), creating a resilient, cost-effective solution.

PQC and QKD are complementary technologies that together secure financial systems against both current and future threats:

“Alternative Key Exchange mechanisms are allowed and those who have a use case for leveraging QKD can proceed to implement it.”

NIST

“This should lead to the deployment across the Union of PQC technologies into existing public administration systems and critical infrastructures via hybrid schemes that may combine PQC with existing cryptographic approaches or with QKD.”

European Commission

“Financial institutions could also implement other quantum security solutions, such as QKD, as part of their risk mitigation.”

Monetary Authority of Singapore

“At JPMorgan Chase, we’re pursuing both approaches, where PQC is mostly used in the application layer and QKD is delegated to work at the network layer and encrypting everything underneath.”

JPMorgan Chase

“The new standards were selected because PQC methods are available today and can be expected to provide a level of resistance to quantum attacks, but ideally the standards of the future will be based in QKD methods.”

Moody’s

NIST PQC standards have been published, but the migration timeline remains uncertain and debated. Estimates range between 2030 and 2035, yet financial institutions’ chief engineers argue that achieving this by 2035 is impossible, even with the necessary resources. In reality, migrating to PQC is far more complex and expensive than expected. What truly matters now is to reduce the risk as soon as possible using the solutions available today.

Migrating to PQC isn’t a single-step solution. Emerging standards and potential breakthroughs in quantum computing – like quantum machine learning (Quantum-ML) – mean that PQC migration will be dynamic, requiring multiple upgrades over time. Financial institutions face significant costs if they delay these migrations and are forced to implement expensive emergency fixes in the future.

PQC is an essential part of the answer, but long-term confidence in current PQC standards is already being questioned. Chief engineers at top global banks highlight the potential vulnerabilities of PQC to advanced Quantum-ML algorithms. Relying solely on PQC leaves banks exposed to emerging quantum threats, leading to repeated, costly migrations.

QKD offers provably secure cybersecurity today by securing key exchange at the physical level, where the attack surface is greatest – Data Center Interconnects (DCI). By integrating QKD now, banks can establish a robust, long-term security foundation, reducing the catch-up cost of future PQC migrations.

Migrating to a quantum-secure stance will take time. Implementing PQC won’t happen overnight, and you will likely need to upgrade some of your existing equipment. That’s where quantum cybersecurity solutions such as QKD can help. Available now, future-proof to computing power evolution and time, you can simply add them as an overlay to your existing infrastructure.

Mitigating risks in SWIFT-based interbank payments and cross-border transfers, which are high-value and mission-critical.

Benefits: stronger financial stability, reduced fraud, and the potential for global security standards.

Backbone securing high-capacity links between data centers and disaster recovery sites.

Benefits: improved security, redundancy, low latency, and continuous availability, with potential for broad adoption and minimal implementation time.

Use of a service provider’s quantum-safe network.

Benefits: cost efficiency, transferring risk, maintaining high security for data transmission and storage, and simplifying the adoption of quantum security measures.

“Quantum safety isn’t a luxury – it’s a necessity.” Regulatory bodies and industry analysts emphasize the urgency of moving to quantum-safe solutions to stay ahead of HNDL and compliance requirements.

“A dual strategy approach is the standard.” Financial institutions agree that combining PQC and QKD delivers the most resilient and cost-effective path forward.

Secure you financial future with ID Quantique

ID Quantique is the global leader in quantum-safe security, trusted by financial institutions, governments, and critical industries worldwide. Our solutions offer seamless integration, future-proofing your infrastructure against today’s and tomorrow’s threats.

Contact us today to learn how we can help you build a quantum-safe infrastructure with a dual PQC + QKD strategy.